Why do we borrow money?

Island Saver gives your child an insight into the world of borrowing, investigating why individuals borrow, considering how we repay loans with interest and identifying when borrowing might not be a good idea. They’ll have the opportunity to make decisions about borrowing in a safe environment, which should help educate them on how to make informed choices about borrowing later on in life.

Personal loans

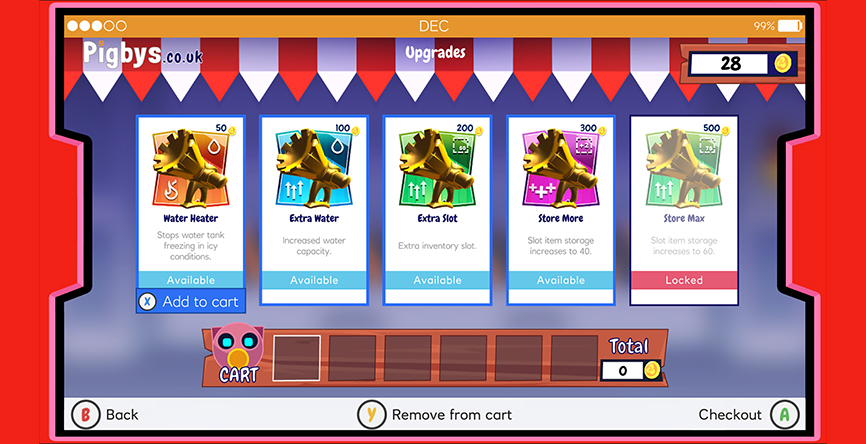

When your child enters Snowy Shores (one of the areas on island two), they will find that their Trashblaster has frozen – this means that they will be unable to continue cleaning the island. In order to solve this problem, your child will be offered a heated water tank upgrade from Pigby’s store. However, if they don’t have enough money saved to buy it outright, your child will be offered a personal loan to buy the upgrade.

Using this scenario, discuss why people might need to borrow money and make sure your child understands that money borrowed has to be paid back. Give examples to your child of real-life items that you can’t always buy outright, e.g. a car, and explain that borrowing can be helpful if it is planned well and the repayments are manageable.

Check your balance

If your child has taken out a loan on the island, ask them to go to their money app on their virtual watch and encourage them to check their loan balance regularly. Explain to them that this is a great habit to get into to make sure payments are being made and to see how much they still owe. From this, they will also be able to calculate how long it will take them to repay the loan.

Track your repayments

Encourage your child to track when their monthly loan repayments are due by checking the top right-hand corner of the screen. They will also get a reminder five days before the payment is due, which should help them understand the importance of prompt repayments. If they don’t make their repayment on time, you can discuss the consequences together.

Borrowing in the UK is regulated by the Financial Conduct Authority who protect consumers by making sure that they are treated fairly and honestly. However, there are circumstances where individuals set themselves up as money lenders – these operations are not regulated and their practise is illegal. Chomper Gold, a smooth-talking loan shark on Island Saver, will show your child how illegal money lenders operate and behave so that they know how to respond if they are ever approached in the future.

Paying interest

Once your child has taken out the loan, allow them to work out how much interest (in doubloons) they will be charged over the course of the loan. How does paying interest make them feel?

On Island Saver the interest rate is 10% – this means that they will pay 10% more, on top of the original amount borrowed. For example, if your child borrows 20 doubloons, they will repay 22 doubloons in total (the extra two doubloons being their 10% interest rate charge).

Meet Chomper Gold

This loan shark will try to convince your child to take out a loan with him instead – his loan appears to be at much better rates than the bank and he makes a pretty convincing case as to why your child should borrow from him. Why not use Island Saver to investigate Chomper’s deal and to explore what he has to offer? Discuss together whether you should trust him and whether you think that his loans might be too good to be true?

Find out about all the latest MoneySense articles for parents by following us on Facebook

Why not try another MoneySense activity

Activities:

Activities: