Why do we save money?

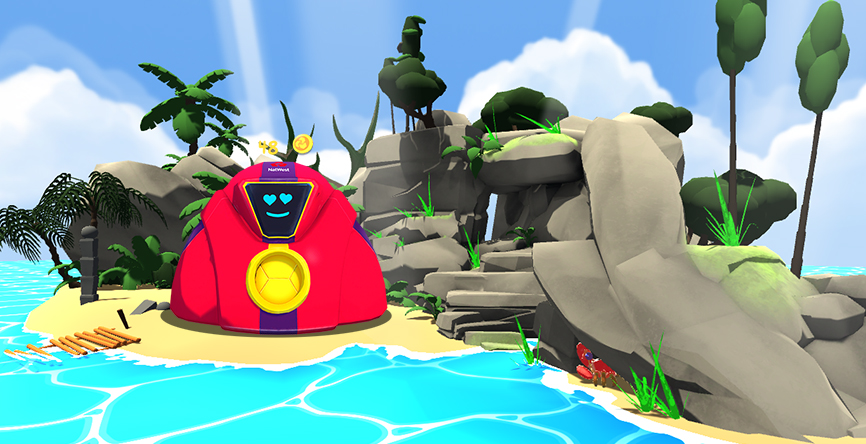

Talking to your child about the importance of saving can help them plan for the future. On Island Saver your child is introduced to the concept of working to earn money – they do this by clearing up the island and collecting coins as a reward for their help. As they deposit coins in the machines, they can start to see their money grow – just like they would with a real-life savings account.

Talking savings

Throughout Island Saver your child is encouraged to save their doubloons in coin deposit machines. They should be able to see how many they have collected in each part of the island by looking at the top of the machine. They can also track their balance by going to their virtual watch and looking at their total account balance in their money app. Ask them to show you how many they have collected and to explain what they have done to earn them.

Keeping money safe

In Island Saver your child can see how many doubloons they have saved in the money app; in real life many people would put their money into a bank or building society savings account to keep it safe. Ask your child to list or draw pictures of the places they might put their money to keep it safe. Next, discuss their ideas and how safe their money might be – they might immediately opt for putting money in a piggy bank at home, but this could lead to the temptation of emptying it frequently!

Spending wisely

In order to advance through the game, your child will have to make decisions about how to spend their doubloons – ask them to explain how they have used their coins to progress through the islands. Did they save up their coins to buy new areas of the island and in turn earn more coins by collecting more litter? Or did they buy seeds to grow food for the bankimals in order to earn more coins for their good deeds? Do they feel that their chosen route was the best way to earn more money?

Having a goal often makes saving easier and encouraging your child to keep track of their money will help them to plan and spend wisely.

Saving plans

If your child has a wish list of things they want to buy, help them put together a savings plan that considers:

- How they will get the money they need (e.g. pocket money, gifts, doing chores)

- How long it will take them to save up for it

- How they will keep track of their savings goal – the MoneySense savings tracker is an easy way for your child to monitor their savings

Interest matters

Interest is a reward or bonus for saving money in an account and in Island Saver the interest gained from saving doubloons is paid on the first day of every month. Your child should notice interest payments being added to their account using their money app and the more coins they put in the bank, the more interest they will earn. Ask them to find out how much interest they get each month using the app.

Feelings about saving

It can be sad to see savings decrease as you spend them. Ask your child to think of three things that they would like to buy and if they would be happy to spend their savings on them.

Step outside the game

If your child doesn’t have a savings account, now might be a good time to consider opening one. You can start by researching the best savings accounts together, then, if possible, take them to a local branch to talk to a member of staff about their choices. Putting money in a savings account is a great way for children to understand the importance of managing money.

Find out about all the latest MoneySense articles for parents by following us on Facebook

Why not try another MoneySense activity

Activities:

Activities: