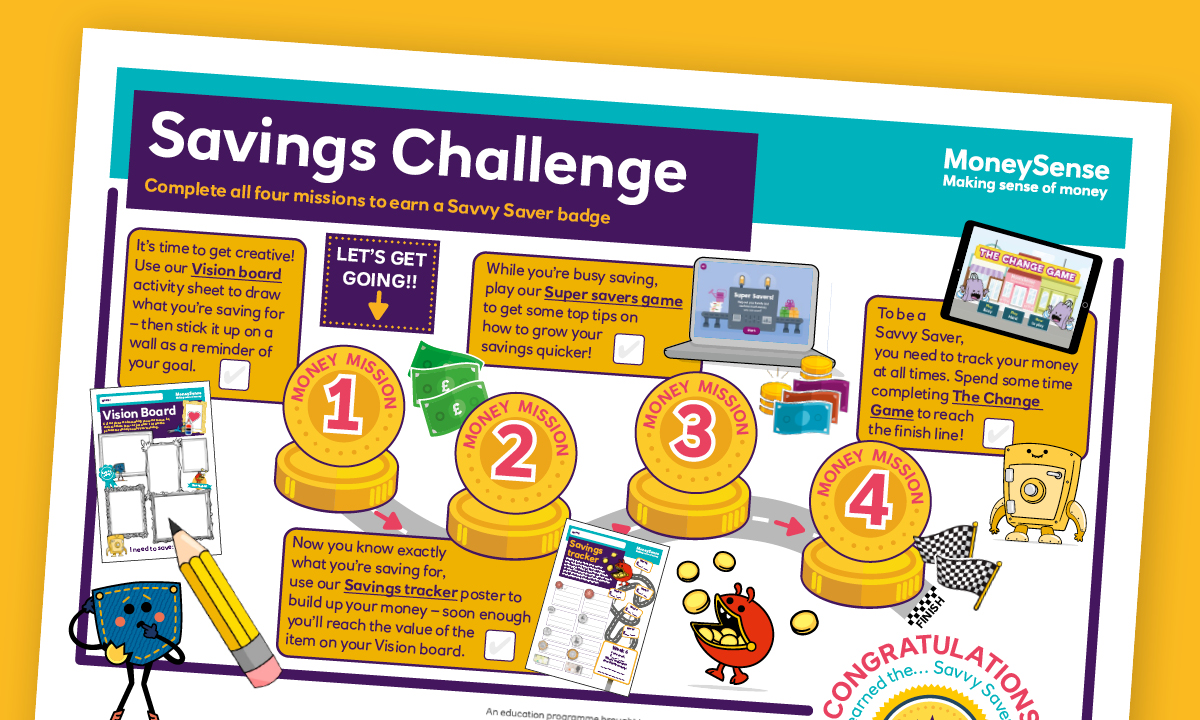

This month's top activities

Want to inject some fun into your kids’ financial education? We can help…

Trending games for children

Interactive money games to bring learning to life

Spot the coin

Age: 5-8

Saving the Day!

Age: 8-12

Virtual bank

Age: 8-12

All About Designing Apps

Age: 16-18

Video learning

Fun videos for kids learning about money

Tell a teacher

MoneySense also has a wide range of classroom resources. If your child’s school isn’t already using MoneySense, tell a teacher about it today!